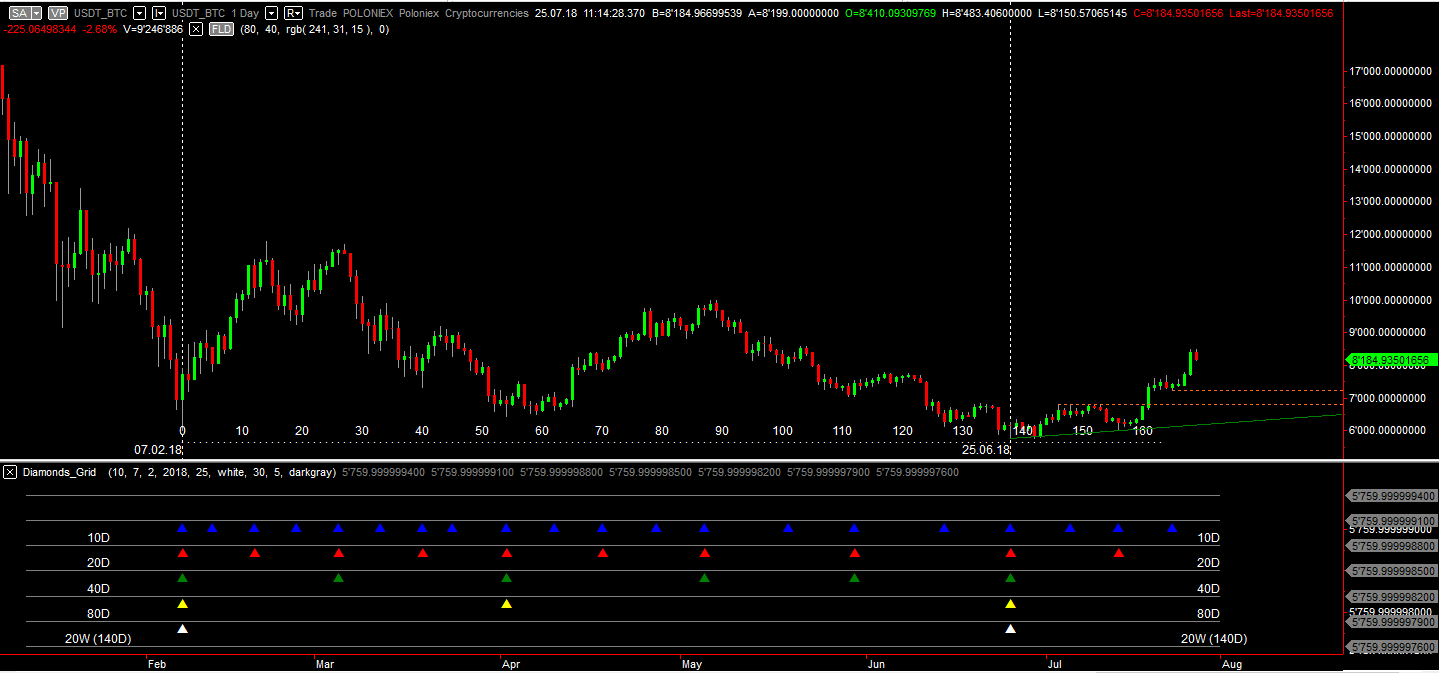

In the last BTC update, I suggested that the risk was skewed to the downside. This was clearly incorrect given strong gains seen over the course of July. Also, I had suggested that the 20W Hurst cycle phase that began off the 7-Feb low was completed on 14-Jun. Having evaluated price action since 14-Jun, a decision has been made to shift the cycle phases slightly to the right to accommodate the low on 25-Jun. This date now represents the end of the above-mentioned 20W cycle phase and price action since this date marks the early stages of the new 20W cycle currently in play.

So with this in mind, what are the implications for BTC? Firstly, let us evaluate the current cycle phases that appear to be complete:

1. Three 10D cycle phases are complete.

2. One 20D cycle is complete.

3. The second 20D cycle phase has peaked and is close to its trough.

Let us also summarise the current Hurst cycle phase directions and how they relate to each other:

| Cycle Phase | Direction | |

|---|---|---|

| 10D | Down | |

| 20D | Down | |

| 40D | Down | |

| 80D | Up | |

| 20W (140D) | Up |

From the cycle relationship above, the suggestion is that the medium-term trend condition at this stage remains bullish, while the shorter-term outlook has peaked. This signals that the near-term outlook will likely see some consolidation and even a pullback in price action in what would initially be viewed as a correction.

A closer look at the cycle phases in the chart reveals that the second of the two 10D cycles, that make up the current 20D phase is close to a trough. Once this trough is confirmed, it would complete a 20D phase and its trough would in turn complete the first 40D cycle of this 20W broader phase. At this juncture, BTC would once again be in a strong cycle position to resume the bull trend. In this regard watch an area of support between 7220 and 6800 that would be expected to remain intact.

To summarise, short-term conditions allow for a pullback in BTC as part of a correction. The 10D / 20D / 40D cycles are close to a trough though and from a timing perspective, these troughs would provide the cycle set-up for another bullish consideration. The next 3-7 days will be important in this regard. Watch support levels at 7220 and 6800.

Good luck!

About the author: Taso Anastasiou is an experienced technical analyst who after all these years still finds the challenges of predicting market movements stimulating. Taso has been involved in the field of communicating financial market ideas for over 20 years having done this through a dedicated research house and the investment banking sector.